Chapter One

“This is an impressive crowd—the haves and the have-mores. Some people call you the elites; I call you my base.”

--George W. Bush, campaign speech, October

2000

George Walker Bush and His

“Base”

There was no embarrassment evident in October of 2000 when

George Walker Bush flattered his campaign audience with the above quip. The “American Dream,” once defined as the

ability to achieve a better life through hard work and determination, has been redefined

through time by the political faction the Bush family represents (typically

investment bankers, who manage “other people’s money”). The new definition defines the dream within

the context of those who have already achieved (or inherited) success and are

only concerned with not going backward.

Thus both Bush presidents have worked to pass elimination of capital

gains taxes, lowering, if not eliminating, income taxes on the wealthiest

American taxpayers, eliminating the estate, inheritance and gift tax, as well

as giving investment banks the right to use the Social Security Trust fund in

their stock manipulations.

All of these schemes

have been designed to assist “the elites,” whom Bush called his base, in

preserving and increasing their wealth. This book is written in order to see

those “elite persons” more clearly. Who are

they? How do they create wealth?

The Bush family has never experienced poverty, at least in

recorded memory. Ann Richards perhaps

said it best in her speech before the Democratic Convention in 1988:

“Poor

George. He can’t help it. He was born with a silver foot in his mouth,”

thus

denigrating the elder George Bush, then seeking the Presidency, for his

inherited position in society as well as his tendency to misspeak. The same aspersion would also apply to

Governor Richards’ 1994 opponent in the race for Texas Governor, George Walker

Bush, who, like his father, had a mysterious access to capital that allowed him

to venture into any new business endeavor he desired.

The word “capital” can only be defined in terms of

surplus—having more than is necessary. In

an ongoing business, working capital is the amount of cash or liquidity

determined to exist when liabilities are subtracted from assets. When a person wants to create a new business,

he seeks “venture capital” from others who are looking for ways to make more

money than they could otherwise make by letting that capital sit idly in the

bank or in a fixed-rate account.

Much has been written about George Herbert Walker Bush’s decision

to create his own oil company in the 1950’s with his friends from Midland, Texas,

but less has been written about who put up the funds that bought equipment for

his operations and provided him a salary before he and his partners actually

struck oil. To whom did he report the

success or failure of his venture? The

same questions can be asked, twenty years later, as George Walker Bush entered

into his own business career—Arbusto, Harken, and the Texas Rangers Baseball

Club. Who put up the funds, and what do

we know about these capitalists? When

did the Bush family first become a part of the circle that gave them access to

this kind of capital?

The answers lie in history.

America’s

First Millionaire

The movement into politically influential circles was a

gradual one that occurred during the working life of Samuel W. Bush in Ohio, and, more

particularly, as a result of his marriage into the prominent and socially

conscious Sheldon family of Columbus,

Ohio. That marriage would give birth to the boy who

would grow up to become the role model for two U.S. presidents. But that’s a story

better saved for later. The most notable

of Samuel’s children was his eldest son, Prescott, father of the first Bush

president and grandfather of the second.

It is Prescott’s

entry into partnership in the newly created investment bank of Brown Brothers

Harriman (BBH), which best explains how his sons and grandsons attained their

access to capital. BBH

began doing

business in 1931, as a result of a merger between the old,

well-established

Brown Brothers & Co. and W.A. Harriman & Co., a deal put

together by Prescott Bush's father-in-law on behalf of the sons of

railroad tycoon E.H. Harriman, who had been Prescott's Skull and Bones

brothers while they were all at Yale during the years just prior to WWI.

The announcement of the planned merger was made the evening

of December 11, 1930

at the residence of Thatcher Magoun Brown, 775 Park Avenue in New York City. The 112-year old merchant banking firm would

be merging with an infantile bank, founded a mere eleven years when the Harriman brothers left Yale. Whether

that merger made possible a continuation of the way Brown Brothers had always

done business, or whether it effected a change from the old order to the new, can

only be answered by comparing the way each bank conducted its business

operations. Such a comparison requires a

study of the family named Brown, and the numerous branches of the Brown family

tree—both in America

and in England.

Capital Rooted in Opium

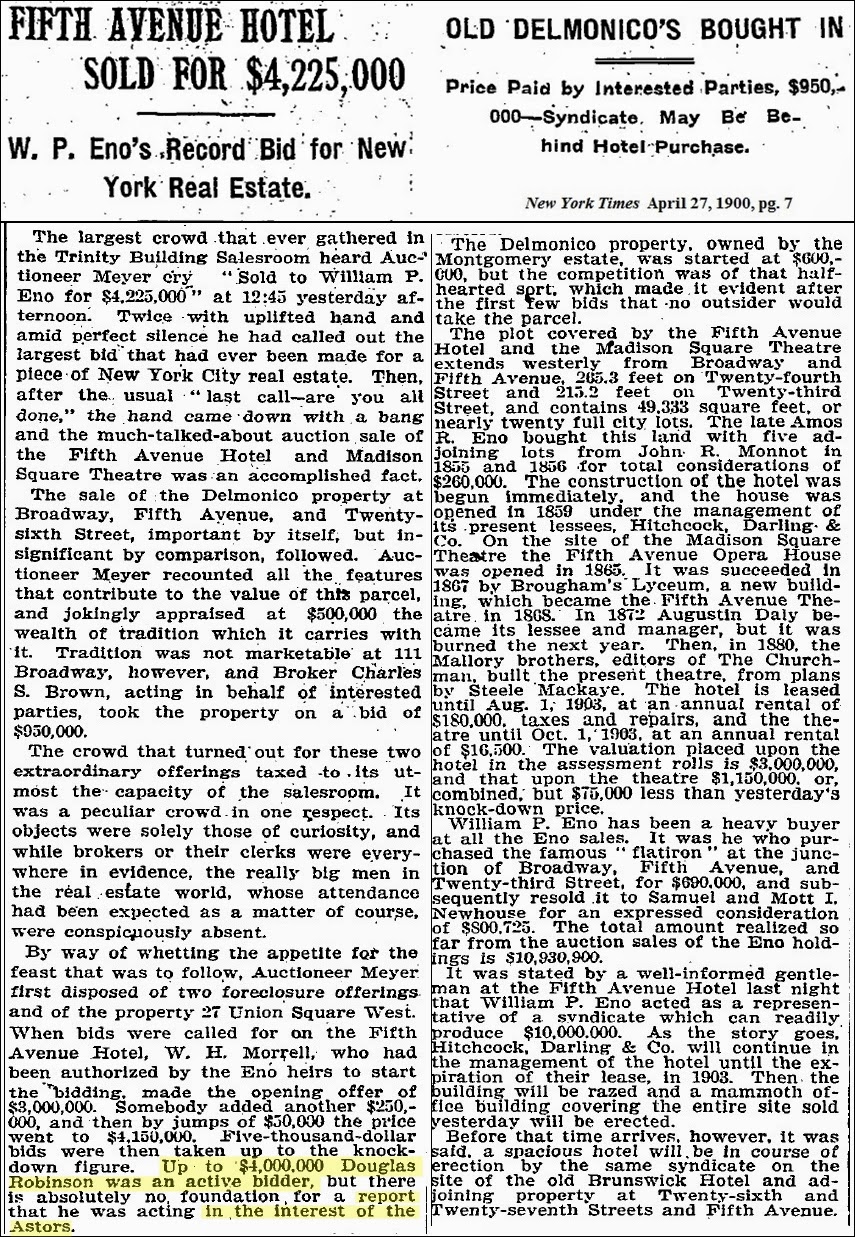

Both Thatcher M. Brown and his new partner, W. Averell Harriman, called 775 Park Avenue home—each having purchased apartments in the new upscale building constructed in 1927. Marketing and sales for the high-rise were contracted to the real estate firm started by Douglas Robinson, a cousin of William Waldorf Astor and a trustee in the Astor Trust Company. John Jacob Astor, progenitor of the Astor fortune and often called “America’s first millionaire,” was a mysterious magnet for money. His biographer, Axel Madsen, explained how German immigrant to America, John Jacob, accumulated the original capital he would later invest in money-making ventures:

Both Thatcher M. Brown and his new partner, W. Averell Harriman, called 775 Park Avenue home—each having purchased apartments in the new upscale building constructed in 1927. Marketing and sales for the high-rise were contracted to the real estate firm started by Douglas Robinson, a cousin of William Waldorf Astor and a trustee in the Astor Trust Company. John Jacob Astor, progenitor of the Astor fortune and often called “America’s first millionaire,” was a mysterious magnet for money. His biographer, Axel Madsen, explained how German immigrant to America, John Jacob, accumulated the original capital he would later invest in money-making ventures:

|

| John Jacob Astor |

The upper end of the opium trade, however, belonged to a

British monopoly. The East India Company devoted thousands of hectares of

fertile land in Bengal to the cultivation of

opium. The harvest was auctioned at Calcutta,

while the yields of individual growers were sold in Bombay. Chinese dealers preferred chests that

bore the stamp of the East India Company because the crops of independent

growers were often adulterated with molasses or cow dung. Turkish opium was

inferior to Bengal imports. Still, one picul—a

Malay unit of weight used throughout Southeast Asia

and equal to 60 kilograms—of unrefined Turkish opium fetched $500 in Canton. Here, dealers

used it to adulterate the high-grade opium from India. Horrified at the harm done

to China's

health, Emperor Daoguang, a reformer who came to the throne in 1821, ordered

that all those convicted of opium smoking be given one hundred strokes. A

sentence also stipulated that for two months an addict should wear a heavy

wooden collar through which the hands were locked. A number of dealers were

executed. These measures, however, proved futile.

Astor dabbled in the opium trade because nearly

everybody else did. Olyphant & Company, one American firm that refused to

carry opium in its vessels, was nicknamed “Zion's Corner.” J. J. didn't hide behind the

pieties of those who claimed they sent narcotics to China to accelerate the conversion

of the heathen Chinese to Christianity. He was in it because it increased

profits. [1]

Corporate Models and Nominees

Astor had abandoned the opium trade by 1821, turning instead to the importation of liquor to use in trade with Indians. With his profits he bought Manhattan leases and land on the outskirts of the then-small city of New York, assets passed down to his family for many generations, mostly in trusts in a generation-skipping fashion. These trusts had to be managed by bankers, with income available for the beneficiaries, while any surplus capital could be reinvested by the managers or trustees, who, in the days before the rise of corporate entities, often held title in their own names pursuant to an underlying contract authorizing them to hold title as nominees for the trust beneficiaries. Over the years laws have been changed from one state to another to make it easier for the real owner of property to be kept secret behind corporations, limited partnerships, limited liability companies and other legal forms or models.

Astor had abandoned the opium trade by 1821, turning instead to the importation of liquor to use in trade with Indians. With his profits he bought Manhattan leases and land on the outskirts of the then-small city of New York, assets passed down to his family for many generations, mostly in trusts in a generation-skipping fashion. These trusts had to be managed by bankers, with income available for the beneficiaries, while any surplus capital could be reinvested by the managers or trustees, who, in the days before the rise of corporate entities, often held title in their own names pursuant to an underlying contract authorizing them to hold title as nominees for the trust beneficiaries. Over the years laws have been changed from one state to another to make it easier for the real owner of property to be kept secret behind corporations, limited partnerships, limited liability companies and other legal forms or models.

|

| Reporters speculated that Robinson was bidding for Astor. |

The

trustees who managed the estate thus had the use of the funds at their own

discretion. Douglas Robinson attained his status as trustee because of his

relationship to the family circle—that “gold ring” that surrounded the Astor

family. Born in Scotland, Douglas in 1882 married Corinne Roosevelt, the sister of

Theodore Roosevelt, President of the United States from 1901-1909. The Robinsons’ daughter, also named Corinne,

would marry Joseph W. Alsop IV in 1909 and remain very close to her first cousin

Eleanor, who married another Roosevelt—fifth cousin, Franklin.

Was British Socialism Extracted from Poppies?

Both Corinne Robinson and Eleanor Roosevelt were sent to Allenswood, a school near London, where they were taught by Marie Souvestre, a feminist educator who “sought to develop independent minds in young women.” Souvestre continued a correspondence with Eleanor long after her departure from the school.[2] One of Eleanor’s teachers at Allenswood was Dorothy Strachey, sister to Lytton Strachey, who helped organize the “Bloomsbury Group,” in London in 1905.

The Stracheys were children of an upper-middle-class family headed by their father, Sir Richard Strachey, a colonial Indian civil servant and civil engineer and British army general during Lord Robert Cecil Salisbury’s tenure in the India Office when Britain faced the problem of maintaining a complex empire in South Asia.[3] Lytton Strachey’s father and one of his half a dozen uncles servicing in India civil service, Sir John Strachey, were colleagues of Lord Cromer (of Barings Bank) on the Indian Council, while Sir John was also Viceroy of India for a time.[4] During the years when Sir Stafford Northcote was Secretary of State for India, Sir John and General Richard Strachey wrote Finances and Public Works of India, which stated at page 136:

Both Corinne Robinson and Eleanor Roosevelt were sent to Allenswood, a school near London, where they were taught by Marie Souvestre, a feminist educator who “sought to develop independent minds in young women.” Souvestre continued a correspondence with Eleanor long after her departure from the school.[2] One of Eleanor’s teachers at Allenswood was Dorothy Strachey, sister to Lytton Strachey, who helped organize the “Bloomsbury Group,” in London in 1905.

The Stracheys were children of an upper-middle-class family headed by their father, Sir Richard Strachey, a colonial Indian civil servant and civil engineer and British army general during Lord Robert Cecil Salisbury’s tenure in the India Office when Britain faced the problem of maintaining a complex empire in South Asia.[3] Lytton Strachey’s father and one of his half a dozen uncles servicing in India civil service, Sir John Strachey, were colleagues of Lord Cromer (of Barings Bank) on the Indian Council, while Sir John was also Viceroy of India for a time.[4] During the years when Sir Stafford Northcote was Secretary of State for India, Sir John and General Richard Strachey wrote Finances and Public Works of India, which stated at page 136:

For many years the ordinary financial condition of India had been

one of chronic deficit; and the main cause of this state of affairs was the

impossibility of resisting the constantly increasing demands of the local

governments for the means of providing every kind of improvement in the

administrations of their respective provinces. Their demands were practically

unlimited, because there was almost no limit to their legitimate wants, and the

local governments had no means of knowing the measure by which their annual

demands upon the Government of India ought to be regulated. They had a purse to

draw upon of unlimited, because of unknown, depth. . . . They found by

experience that the less economy they practised, and the more important their

demands, the more likely they were to persuade the Government of India of the

urgency of their requirements.[5]

This

same concern was also expressed by the utilitarian writer, John Stuart Mill, an

employee of the British East India Company for more than three decades, who

“drafted his Logic and Principles of Political Economy on the

Company's stationery while so employed. In spelling out his necessary

conditions of development for Indians, Mill stood amidst a long line of British

writers who addressed the question of India as a codicil of the European

invention of development.”[6] As early as 1804 when Thomas Malthus became a

charter member of the faculty of the newly established staff training college

of the East India Company at Haileybury, John S. Mill’s father, James Mill, was

hired as a Company administrator with help from Jeremy Bentham, with whom he

became associated in 1806, and John Stuart started his own 35-year career there

in 1823.

It was during the aftermath of the 1857 mutiny and revolt J.S.

Mill wrote Memorandum of the Improvements in the Administration of India—a

defense of the East India Company against the revocation of its governmental

privileges. The Strachey family had a

connection to the Indian civil service that was well over a century old by the

time Mill wrote his treatise.

“By the mid-nineteenth century, two scions of this family, John and Richard Strachey, had risen to high office in India. In 1882 the Stracheys co-authored the retrospective of their lives' work, The Finances and Public Works of India from 1869 to 1881, and dedicated the book to ‘the public servants of all classes the results of whose labours for the people of India [were] herein recorded…by their fellow workers’. In their final chapter, the Stracheys addressed the question of the ‘future requirements of public works and finance in India’. Here, they reflected that ‘the recent remarkable progress of India, which has been placed beyond every reasonable doubt, may be traced up to the natural productive powers of the country, for the development of which greatly increased facilities have been given by the extension of railways and cheap transport’. Yet, there was no time to cry, ‘Rest and be thankful.’ The Stracheys argued that, as the famines of the 1870s had shown, much more needed to be done. How was this work to be accomplished? Their answer was that ‘experience’ had ‘established beyond dispute that it is within our power both to construct and work railways economically through state agency’. Moreover, the Stracheys continued, it was in the financial interests of the Government of India to do so:

for, it may without hesitation be said that in the case of lines yielding a profit…the amount which would be carried out of the country by a company of foreign capitalists…must be greater than the charge incurred under Government management…since the profits, even if smaller, would all remain in India.[7]

How Bankers and Accountants Hide the Source

At the same time Sir Stafford Northcote was contending with Indian provincials’ demands for more from the British government, similar pleas for money were coming from Canadian colonials. Sir Stafford, who began heading Hudson’s Bay Company in 1869, traveled to North America to discuss a way to resolve the situation, using the International Financial Society, set up in the early 1860’s, as one possible means to raise funds outside the Government’s taxing mechanism. By 1868 another new financing mechanism had been created—the investment trust—the first of which was the Foreign and Colonial Government Trust, which:

At the same time Sir Stafford Northcote was contending with Indian provincials’ demands for more from the British government, similar pleas for money were coming from Canadian colonials. Sir Stafford, who began heading Hudson’s Bay Company in 1869, traveled to North America to discuss a way to resolve the situation, using the International Financial Society, set up in the early 1860’s, as one possible means to raise funds outside the Government’s taxing mechanism. By 1868 another new financing mechanism had been created—the investment trust—the first of which was the Foreign and Colonial Government Trust, which:

was very successful and soon had a number of imitators.

In 1873 the five trustees of the Foreign and Colonial Government Trust set up

the first trust company specifically devoted to investment in American railway

securities, the American Investment Trust.[8]... In

April the most famous of all these companies, the Scottish American Investment

Trust, was inaugurated.[9]... Most

of these companies also engaged in various other financial operations. They not

only undertook the flotation of American railway shares but also bought and

sold on such short terms that their operations came perilously close to the

borderline of speculation. Nevertheless, the investors were highly satisfied

with the returns. The trustees also profited, especially from the founders’

shares. Moreover, there were also intangible profits. The group of men who made

up the trustees of these various companies became a power in the City.[10]

It

is the Scottish American Trust that is most useful in understanding the connection

between Scottish capital and American enterprise in the decades following America’s civil

war, when another sort of war was going on within the British establishment

concerning the maintenance of the colonial empire:

Theories and attitudes to colonial development unfolded

only very slowly and uncertainly in this period, which is not surprising,

considering that it was a time when British attitudes to the empire as a whole,

and to the tropical colonies in particular, were still confused and incoherent.

On the one hand, there was what might be called the ‘unofficial orthodoxy’ of

the Manchester school of laissez-faire dogmatism, based on the worship of free

trade, which believed that, provided Britain was powerful enough to enforce

free trade (or something approaching it) on tropical regions, formal colonial

rule was unnecessary: and on the other hand there was the whole tribe of

traders, merchants, missionaries and colonial administrators who had a vested

interest in maintaining the tropical colonies, and in some cases in expanding

them. Since possession is said to be nine-tenths of the law it is perhaps not

surprising in retrospect that those who represented the vested interests were

ultimately successful; and that the advocates of abandoning the colonies (the

settlement colonies as well as the tropical ones) were eventually defeated—as

much by the course of events—as by any determined new policy of expansion.[11]

This

“Manchester

school” centered in the Lancashire

district—the heart of the textile industry—was also the location of many of the

investors of the International Financial Society formed by Sir Edwin Watkin,

promoter of the Grand Trunk Railroad from the east to west coasts of Canada. This financing mechanism was a separate

entity,

capitalized at three million pounds—divided into 150,000

shares—all of which were bought by the important London banking firms. The sale of stock was closed in June 1863,

and the new shareholders (the London

banks) elected Sir Edmund [Walker] Head as governor of the Company, with other board

members being Richard Potter, Daniel Meinertzhagen, James S. Hodgson and J.H.W.

Schroeder from the banks. Shares in the

new company were then placed for sale on the open market. However, almost a year later, the society

still owned a large block of stock. The

Society's minutes reflect that by 1867 it owned a mere 3,000 shares.

The

Daniel Meinertzhagen named above headed the banking house owned by his

father-in-law, Frederick Huth. In 1873

his son, also named Daniel, married one of the daughters of another board

member of the International Financial Society—Richard Potter—the wealthy father

of soon-to-be-famous Beatrice Potter Webb, one of the founders of the Fabian

Socialists. Potter was building the

Grand Trunk Railroad in Canada. Daniel was also

the father-in-law of Alexander Frederick Richmond (“Sandy”) Wollaston, the second son of George

Hyde Wollaston, who was related by the marriage of Ann (daughter of Frederick Eustace Arbuthnot Wollaston) into the family of Alexander

Brown of Baltimore.

Alexander Brown's son James had gone to New York after the Erie Canal opened in order to take advantage of the trade that was opened up by that scientific wonder in 1825. James was the senior partner in the Brown Brothers investment bank which after the 1929 crash was in dire need of new capital. That was when the Harriman boys came along and through Prescott Bush's father-in-law George Herbert Walker, negotiated to take over the bank's investment portfolio, as mentioned previously. We can only wonder at this point in time how much of those investments still derived income from opium.

|

| Click to enlarge file. |

Alexander Brown's son James had gone to New York after the Erie Canal opened in order to take advantage of the trade that was opened up by that scientific wonder in 1825. James was the senior partner in the Brown Brothers investment bank which after the 1929 crash was in dire need of new capital. That was when the Harriman boys came along and through Prescott Bush's father-in-law George Herbert Walker, negotiated to take over the bank's investment portfolio, as mentioned previously. We can only wonder at this point in time how much of those investments still derived income from opium.

[1] Axel

Madsen, John Jacob Astor: America's First Multimillionaire (New York: John Wiley & Sons, Inc., 2001), pp.

166-167.

(New York: John Wiley & Sons, Inc., 2001), pp.

166-167.

[2] Betty

Boyd Caroli, The Roosevelt Women: A Portrait In Five Generations (New York: Basic Books,

1998).

(New York: Basic Books,

1998).

[3] “Giles

Lytton Strachey (1880-1932),” Encyclopedia of World

Biography, 2nd ed. 17 Vols. Gale Research, 1998. According to statistics reflected by

the “Statistical Abstract of British India,” presented annually to Parliament,

Sir John Strachey’s Financial Statement of 1877, (V/16/344), OIOC, and Judith M. Brown , Modern India: The Origins of an Asian Democracy (Oxford, 1985),

p. 125:

, Modern India: The Origins of an Asian Democracy (Oxford, 1985),

p. 125:

Salisbury’s 1866 budget speech, for all the confidence with which it was imbued, could not disguise the fact that Indian revenues could not be counted upon for any extensive program of public works. The government drew its revenue from six main sources: land, opium, stamps, salt, excise, and customs. Of these the revenue from land was by far the largest, accounting for some 40 percent of a total net revenue in the 1870s of around £38,000,000 per annum. Since this revenue was either permanently fixed or subject to only thirty-year reassessments, it could not be raised to meet extraordinary costs or provide for public works investment. Neither was the second largest source of revenue, that from opium sales to China, which accounted for around 15 to 17 percent of total revenue, a reliable or expandable source. Unlike the Chancellor of the Exchequer who could rely on gin sales in Britain, Salisbury noted, opium sales faced the risk that the Chinese government would look elsewhere for its opium. Furthermore, although currently producing a high return, it was subject to fluctuations in price. That made him look ‘with some anxiety on the statement that the Indian budget depends on the yield of opium not falling far short of the highest rate it has ever yet attained.’ (quoting Paul R. Brumpton, Security and Progress: Lord Salisbury at the India Office (Westport, CT: Greenwood Press. 2002), 127.)

[4] John Loe Strachey , The Adventure of Living: A

Subjective Autobiography—1860-1922 (New York: G.P. Putnam’s Sons, 1922),

367. Lytton’s father started his career as

a subaltern in the Honourable East India Company’s Corps of Sappers and Miners.

, The Adventure of Living: A

Subjective Autobiography—1860-1922 (New York: G.P. Putnam’s Sons, 1922),

367. Lytton’s father started his career as

a subaltern in the Honourable East India Company’s Corps of Sappers and Miners.

[5] Quoted

in Andrew Lang , Life, Letters and Diaries

of Sir Stafford Northcote, First Earl of Iddesleigh. Volume: 1 (Edinburgh

and London: W. Blackwood and Sons,

1890), 276-277. Strachey

, Life, Letters and Diaries

of Sir Stafford Northcote, First Earl of Iddesleigh. Volume: 1 (Edinburgh

and London: W. Blackwood and Sons,

1890), 276-277. Strachey , The Finances and Public Works of India from 1869 to 1881 (London, 1882), 401-402.

, The Finances and Public Works of India from 1869 to 1881 (London, 1882), 401-402.

[6] M. P.

Cowen and R. W. Shenton, Doctrines of

Development (London: Routledge,

1996), 42.

[7] Cowen

and Shenton, 54. Passages quoted therein

from Strachey and Strachey (1882), pp. 401-2.

[8] The five

trustees were: Lord Westbury, Lord Eustace

Cecil, G.M.W. Sandford, G.W. Currie, and Philip Rose. Philip Rose, it should be noted, was not a

member of the firm of Morton, Rose and Co. but of a firm of lawyers.

[9] According

to a footnote to the quoted text, the trustees were: James S. Fleming, cashier

of the Royal Bank of Scotland; James Syne, manager, British Linen Co.; W.J.

Duncan, manager, National Bank of Scotland; and William Thomas Thomson,

manager, Standard Life Assurance Co. An

additional reference recommends W. Turrentine Jackson, The Enterprising Scot: Investors

in the American West after 1873 (Edinburgh:

Edinburgh University Press, 1968) at 13 ff.

[10] Dorothy

R. Adler, British Investment in American Railways 1834-1898 (Charlottesville, Va.: The University Press of Virginia,

1970), p. 92. Adler cites The London

Times (March 20, 1868), as the first appearance of any mention of The

International Financial Society.

(Charlottesville, Va.: The University Press of Virginia,

1970), p. 92. Adler cites The London

Times (March 20, 1868), as the first appearance of any mention of The

International Financial Society.

[11] Michael

Havinden and David Meredith, Colonialism and Development: Britain and its Tropical Colonies, 1850-1960 (New York: Routledge, 1993), 45.

(New York: Routledge, 1993), 45.

Chapter One of Linda Minor's unpublished book about the history of Brown Brothers bank and the genealogy of Brown family descendants.

Chapter One of Linda Minor's unpublished book about the history of Brown Brothers bank and the genealogy of Brown family descendants.

No comments:

Post a Comment